can you work part time if you receive social security disability

Under the TWP incentive you can receive your full benefits for nine months in any five. Called the SGA for substantial gainful activity the limit in 2020 was 2110 per month for blind recipients and 1260 for other disability recipients.

/GettyImages-175535394-a9137dddf20f4bcd8925725cfcbc5049.jpg)

When To Apply For Social Security Retirement Benefits

Updated February 2 2022.

. If you receive benefits and are under full retirement age and you think your earnings will be different than what you originally told us let us know right away. In conclusion you can work part-time while applying for social security disability benefits as long as you earn under SGA. These rules allow you to test your ability to return to full-time work without having your monthly disability benefits stop.

Generally self-employed individuals can currently work up to 45 hours per month about 10 hours per week and still be eligible for disability benefitsif they arent the only person working for the business and they arent making substantial income. We can answer questions make recommendations and find the right lawyer for you. Incentives and Trial Work Periods for Disability Recipients.

The long answer however is maybe. You reported your work but your duties hours or pay change. Generally Social Security will find you disabled if you cant sustain full-time work on a regular basis.

Are You Taking Part in One of Social Securitys Work Incentives Programs. Ad A SS Expert Will Answer You Now. Yes you can work part-time on Social Security Disability as long as your income does not exceed the allowable income limits set by the Social Security Administration SSA.

For 2014 if you earn more than 770 in any given month while receiving SSD you will be automatically begin a TWP. Receive Social Security disability If you receive Social Security because of a disability you or your representative must tell us right away if any of the following occur. Social Security is for those whove reached early or full retirement age while disability insurance typically serves younger individuals who cannot work due to serious medical conditions.

You start or stop work. To remain eligible for Social Security disability benefits you cannot receive employment income that is greater than the substantial gainful activity SGA limit. Ad When injury or illness strikes Atticus helps you claim the aid you deserve.

But its actually quite a bit more complicated than this. The SSA will consider the specific facts of your case in determining whether your part-time job disqualifies you for SSDI benefits under the SGA standard. But there are of course some rules and regulations that Uncle Sam has imposed for you to continue to receive payment if youre working while collecting SSDI benefits.

The SGA limit for 2018 for a non-blind person is 1180 a month and for a blind person is 1970 a month. The SSA will look at not only how much you are making. If you are working I highly recommend you retain an experienced SSD attorney to handle your claim.

The short answer is probably not. You can continue to receive your Social Security disability benefits while working during whats referred to as a Trial Work Period TWP. The SSA wants you to work so the amount of benefits they have to pay out is reduced.

According to Nolo you should use caution if you are working while waiting for. In 2022 the SGA limit to be eligible for Social Security disability benefits is 1350 per month and 2260 per month for blind individuals. This disability planner page lists some of the circumstances that can change your eligibility for benefits after you start receiving them how often we review your case to check whether you are still disabled the two things that can cause Social Security to decide that you are no longer disabled and what happens if you go back to work while you are receiving benefits.

The Social Security Administrations Ticket to Work program and work incentives can help people work while receiving Social Security Disability Insurance SSDI or Supplemental Security Income SSI benefits. The Social Security Administration allows individuals receiving benefits to work as long as their income stays below a certain amount. Therefore most recipients receive SSDI in place of working.

As long as your earnings dont exceed a certain amount set by the SSA each year it is often not problematic to work part-time within these limits. The SSAs income limits let you earn up to 1260 per month or 2110 per month if you are blind and still receive your full disability benefits. For SSDI you can only receive benefits if you cannot work a full time job or enough to be considered substantial gainful activity 1350 per month 2260 if youre blind.

Get Unlimited Questions Answered. You start paying expenses for work because of your disability. The trial work period rules which were designed for people already receiving benefits allow a person to earn any amount per month for nine months and still receive their monthly disability benefits.

You may pass step 1 of the evaluation process but certainly getting past the following steps will be difficult to explain. It is possible to work part time but this can make it harder to. Please call us at 1-800-772-1213 TTY 1-800-325-0778.

If you need to report a change in your earnings after you begin receiving benefits. See our article on partial disability and part-time work. You cannot report a change of earnings online.

But if your regular work before applying for disability was part-time work and Social Security finds you can still do this work your claim can be denied. Here is a. Ad Social Security Disability Insurance Stops If You Earn More Than Certain Monthly Limits.

At the same time a disabled sales consultant can work 100 hours a month and still make under the 1220 threshold. People receiving Social Security disability benefits can work part-time and still receive their monthly payments. Social Security and SSDI serve similar purposes but the requirements vary for each.

Social Security Disability Insurance. So yes you can work while on social security disability.

How To Qualify For Disability With Parkinson S Disease In 2022

Top 5 Social Security Disability Application Mistakes To Avoid In 2022

A Note To Those Who Think Receiving Disability Benefits Means I Have It Easy

How Much You Can Work Depends On Whether You Collect Ssdi Or Social Security Disability Benefits Social Security Benefits Retirement Social Security Disability

Both Spouses Getting Ssd Benefits At The Same Time

Is Ssi The Same As Social Security Disability As Usa

2022 Disability Calendar When You Should Expect Your Aid Keefe Disability Law

Dictionary Ticket To Work Social Security

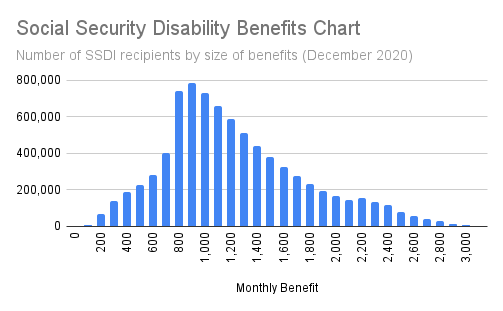

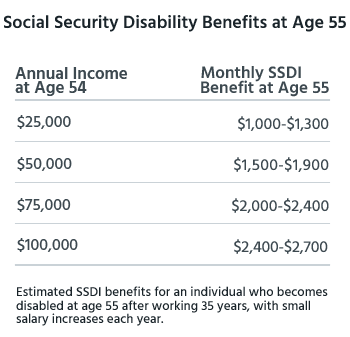

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

How Long Term Disability Works With Social Security Disability Cck Law

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

How Many Hours Can I Work On Ssdi John Foy Associates

If You Are Disabled And No Longer Able To Work You May Be Eligible To Receive Social Securi What Is Social Social Security Social Security Disability Benefits

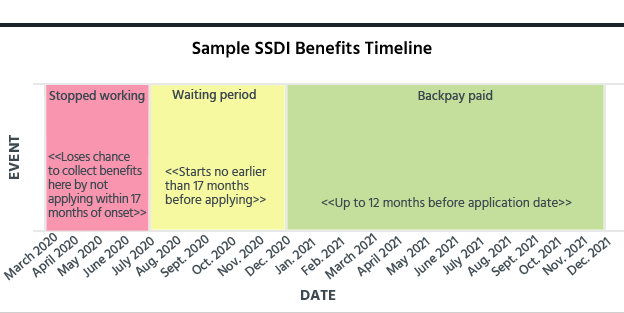

How Long Do You Have To Be Disabled Before You Can Get Benefits Disabilitysecrets

Social Security Changes For 2022 Ssi And Ssdi Increases Sga Limits

Social Security Disability Insurance Ssdi Qualifications

/dotdash_Final_How_Are_Spousal_Benefits_Calculated_for_Social_Security_May_2020-01-29ec05cc8e7241ec95054d75a3d998aa.jpg)

How To Maximize Social Security Spousal Benefits

Ssdi Ssi Retirement Social Security Disability Insurance Supplemental Income Thesitrep Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age